The legal turmoil surrounding President Trump’s 2025 tariff policies has created unprecedented market conditions, directly influencing Bitcoin‘s price trajectory as investors seek shelter from regulatory uncertainty and economic instability.

Legal Challenges Reshape Market Dynamics

Federal courts recently declared Trump’s IEEPA-based tariffs unconstitutional, consequently invalidating massive duties on international goods. This legal uncertainty immediately triggered market volatility, significantly affecting traditional assets. Meanwhile, Bitcoin’s price trajectory demonstrated remarkable resilience during this period. The Supreme Court’s pending decision will ultimately determine the long-term market direction.

Bitcoin’s Price Trajectory Amid Capital Flight

Investors rapidly shifted capital from traditional markets as tariff uncertainties mounted. Surprisingly, Bitcoin ETFs experienced substantial outflows initially, yet Bitcoin’s price trajectory soon stabilized. The cryptocurrency’s fixed supply and decentralized nature provided distinct advantages during this crisis. Consequently, institutional investors began reevaluating Bitcoin’s role in portfolio diversification strategies.

Geopolitical Risks and De-Dollarization Trends

Trump’s tariffs accelerated global de-dollarization efforts, potentially benefiting Bitcoin’s long-term price trajectory. Countries increasingly seek alternative financial systems, thereby creating new demand for cryptocurrency solutions. This geopolitical shift could fundamentally alter Bitcoin’s market position. Additionally, trade alliances reducing dollar dependency may further support cryptocurrency adoption.

Institutional Adoption Strategies Evolve

Major financial institutions now recommend hybrid crypto portfolios to hedge against tariff-driven volatility. These strategies typically allocate:

- 60% to Ethereum for staking yields and smart contract capabilities

- 30% to Bitcoin as primary inflation hedge and safe-haven asset

- 10% to altcoins for diversification and growth potential

This approach optimizes returns while managing risk during legal uncertainties.

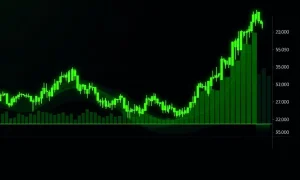

Market Performance Metrics Analysis

The S&P 500’s 12.9% decline in early 2025 contrasted sharply with Bitcoin’s relative stability. Bitcoin’s price trajectory during the Israel-Iran conflict showed a 0.42% gain, demonstrating its evolving safe-haven characteristics. However, historical data from the Ukraine War reminds investors that cryptocurrency volatility remains a significant consideration.

Future Outlook and Investment Considerations

The Supreme Court’s upcoming ruling will critically impact Bitcoin’s price trajectory. A decision against the tariffs could stabilize markets temporarily, while an affirmation might accelerate capital flight to cryptocurrencies. Institutional analysts project potential $3 trillion in crypto demand by 2027, suggesting long-term growth possibilities despite short-term uncertainties.

Frequently Asked Questions

How do Trump’s tariffs directly affect Bitcoin?

Tariffs create macroeconomic instability that drives investors toward alternative assets like Bitcoin, though the effect is indirect through market sentiment and capital flows.

Why did Bitcoin ETFs experience outflows despite tariff uncertainty?

Initial risk-off sentiment pushed investors toward traditional safe havens like gold and TIPS, but Bitcoin subsequently regained favor as the crisis deepened.

What makes Bitcoin a potential safe-haven asset?

Bitcoin’s decentralized nature, fixed supply, and low correlation with traditional markets during certain crises support its safe-haven argument.

How might the Supreme Court ruling impact cryptocurrency markets?

A ruling against tariffs could reduce immediate volatility, while upholding them might accelerate de-dollarization and crypto adoption trends.

What percentage of a portfolio should be allocated to Bitcoin?

Institutional models suggest 20-30% allocations for hedging purposes, though individual risk tolerance should determine exact percentages.

Are other cryptocurrencies better hedges than Bitcoin?

Ethereum offers different value propositions through staking yields, but Bitcoin remains the primary crypto hedge due to its market position and historical performance.